Construction Invoice Factoring

A steady cash flow

By Diane Dennis

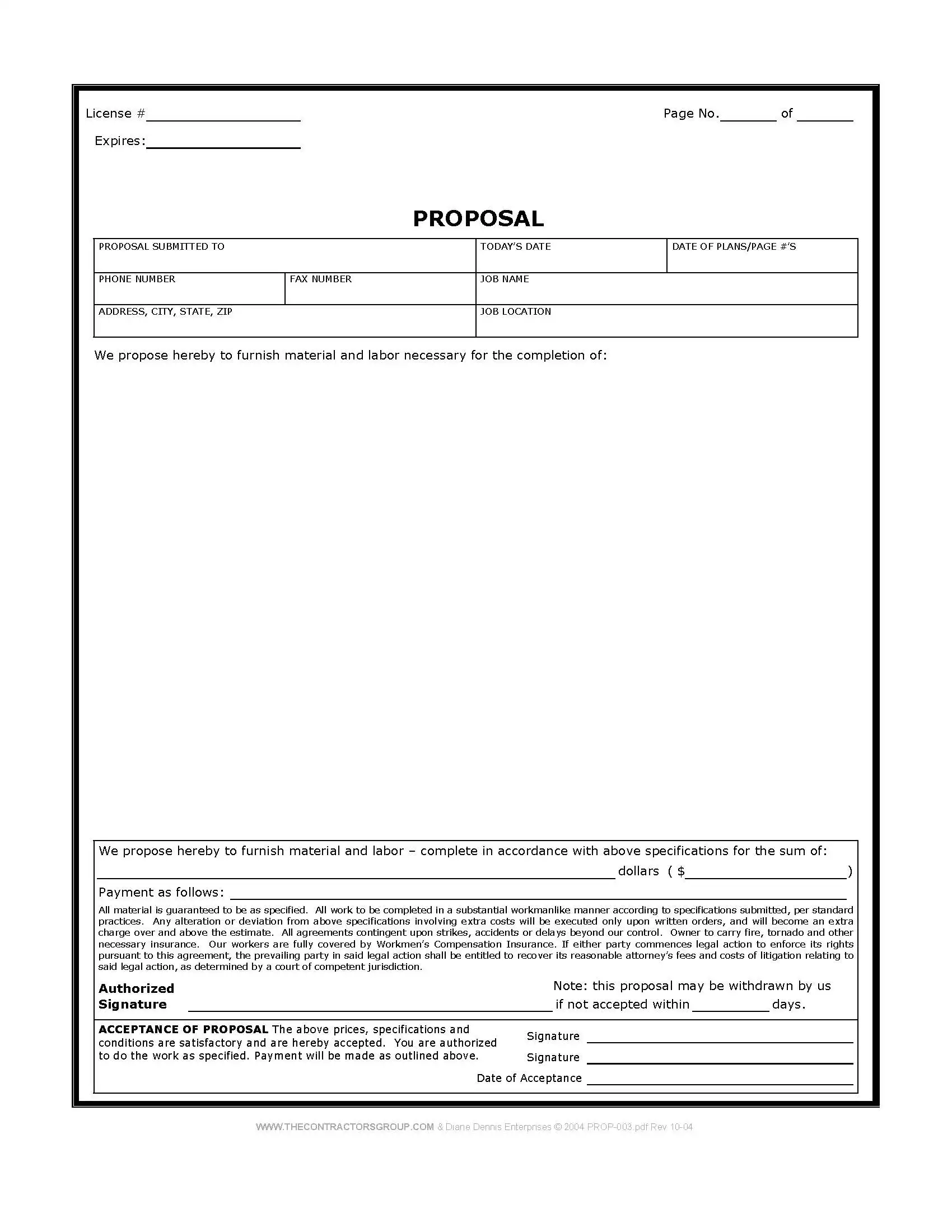

After you've submitted an invoice to your customer the funds due on that invoice are considered 'receivables'; monies on the books that are owed, not yet due and not yet paid.

Because the invoices are typically not due for a minimum of 30 days you're left with no cash in hand for at least that long.

But a steady cash flow is what's needed to keep your business purring. The quick turn-around of construction invoice factoring may be your answer.

Construction invoice factoring can get you funds within 2 days

When opting for construction invoice factoring you are selling your receivable(s) to the factoring company.

The factoring company pays you the $ amount of your invoice(s) less a small fee (usually a percentage of the invoice).t

When it comes time for payment the factoring company collects on the invoice not you, although you may be required to help resolve any issues that might come up.

Whether it's for payroll or utilities or material bills, having funds within one to two days can make the difference between being in business and not [being in business]!

The factor will then collect payment from your customer when the invoice they bought from you comes due 30 or so days later.

With most factoring companies you can 'factor' as many or as few of your invoices as you wish, with no quotas to be met or anything like that.

Contact several different receivables factoring companies and ask about their rates, points, time frame for payout, etc.

A look at the cost of factoring your receivables

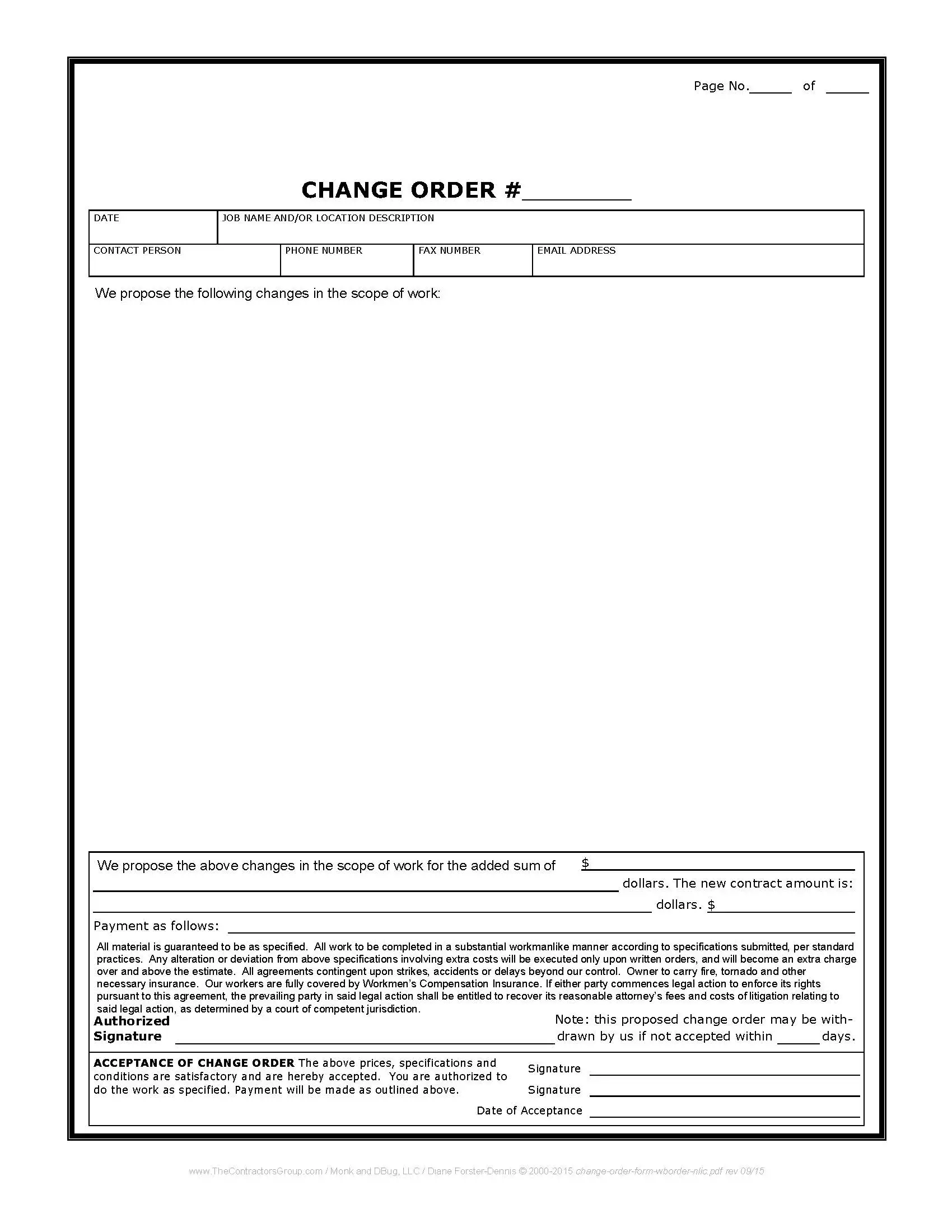

As an example... A contractor (Generals/Directs and Subs) has an invoice of $100,000 that he sells to the factoring company.

Please note that all of the numbers I've used are hypothetical.

The

factor charges 3% ($3,000) per month to factor the invoice. They pay 70%

($70,000) of the invoice to the contractor immediately and then they

sit on 30% ($30,000) until after the customer has paid the invoice.

When the general/direct contractor pays the invoice by the due date the subcontractor will receive $27,000 from the factor. That's the $30,000 that the factor had 'on hold' less the $3,000 fee.

$ 30,000 on hold

$ 3,000 3% fee on $100,000 invoice

$ 27,000 paid to contractor after customer pays invoice

Be sure to ask about what happens if your customer pays the invoice late? Does the monthly cost remain the same, go down, go up, what?

It's a sad fact that customers pay late. It's best to know the policy before it happens (and before you decide whether or not to factor the invoice).

Please note that the figures I used are strictly hypothetical. Please check with the various receivables factoring companies for information on their fees, polices, etc.

Chances are you'll be asked a few questions. Some possible examples:

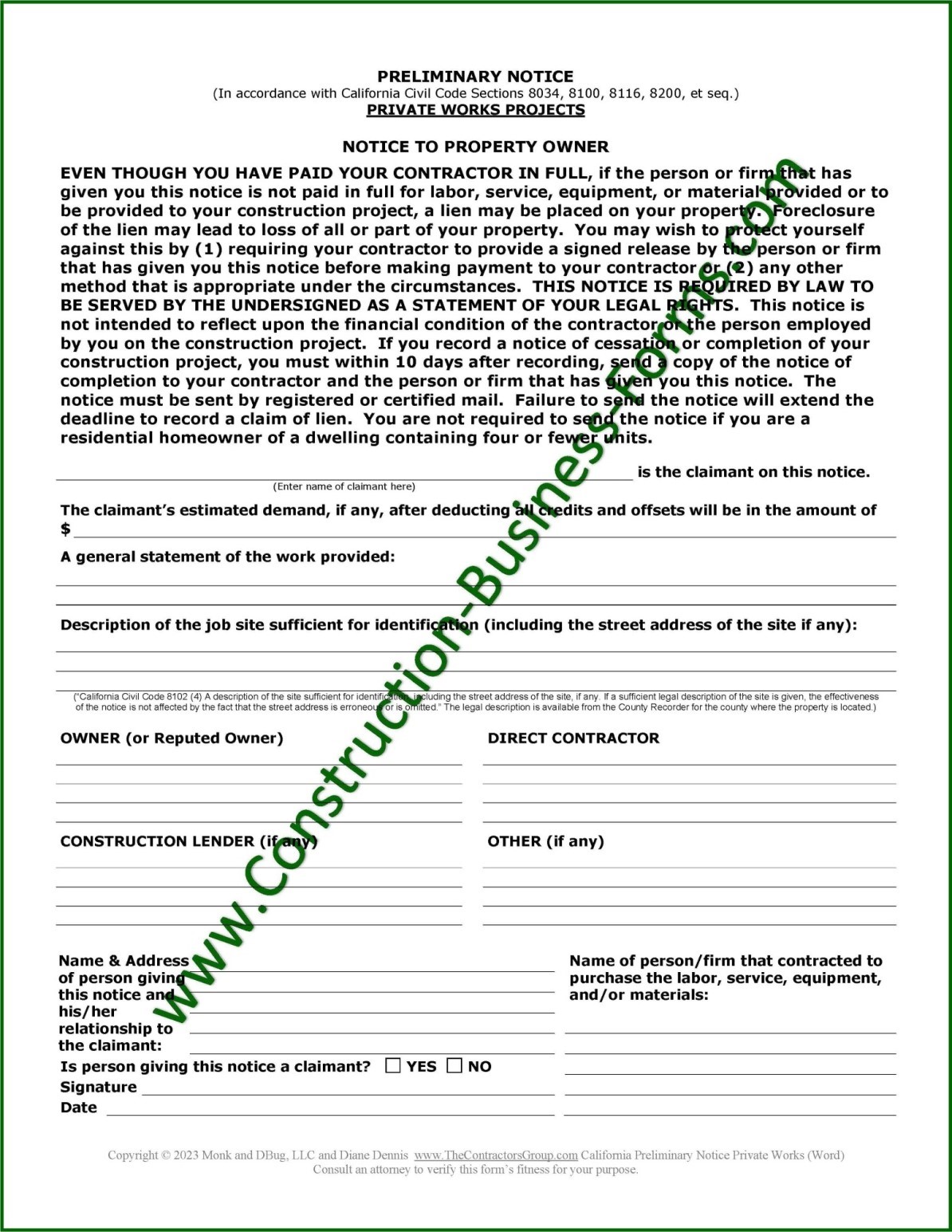

- Does your company have a bank line

- Does your company have any liens (local, state, federal)

- Is your customer bonded

No doubt they'll have quite a few more, those are just a few examples of what might be asked of you.

Construction invoice factoring makes your 'payables' ... payable ;o)

It's a tantalizing thought, being able to collect on your invoices in two days time (30 days can be a friggin long time I know ... been there, done that).

Just imagine the strides you could make with your company if your receivables were available to you within two days after you submit your invoice(s)!

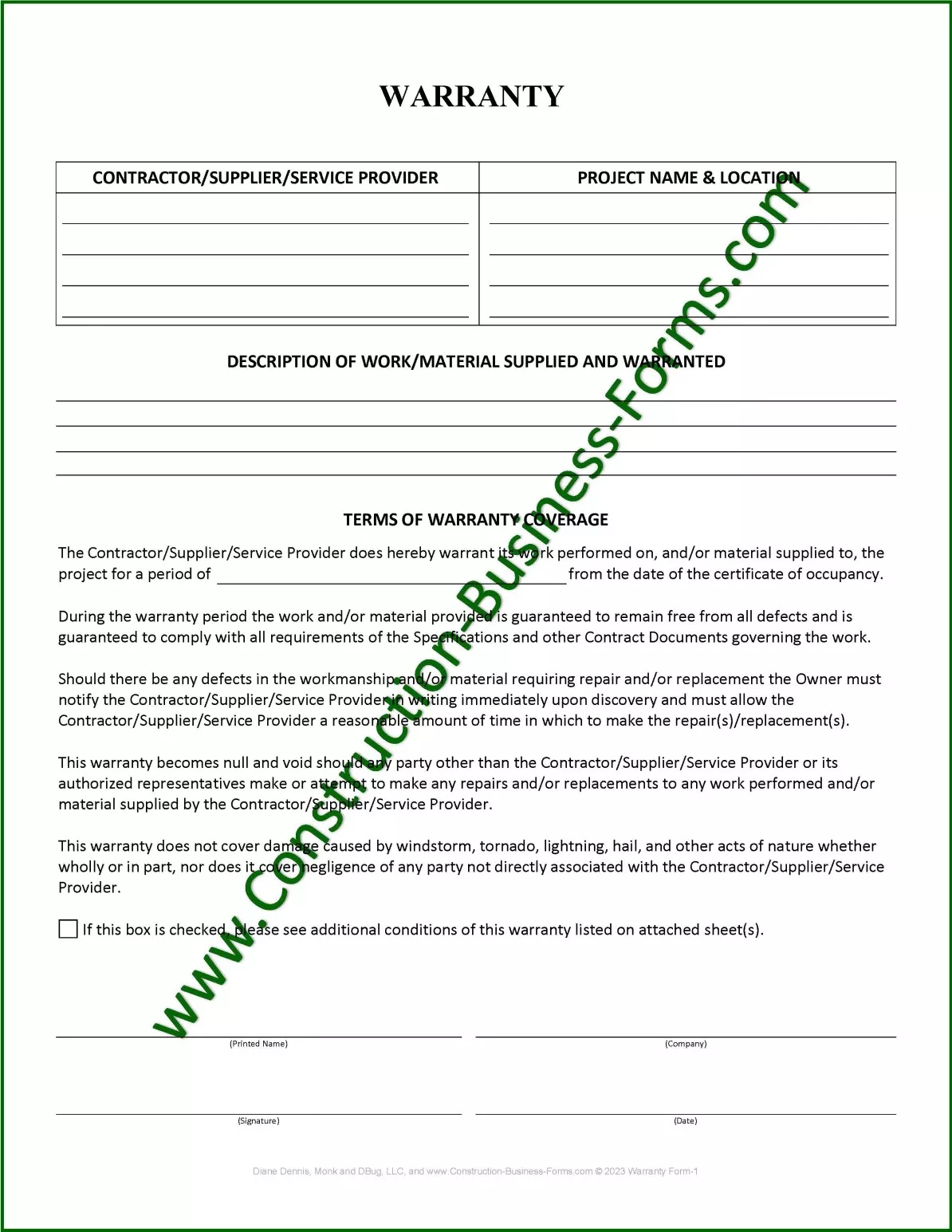

You'll be able to:

- Pay the invoices for your project materials on time if not early

- Keep the utilities turned on

- Keep

paper and [ridiculously expensive] printer ink on hand (nothing worse

than running out of ink while printing a proposal, except maybe while

printing an invoice) ;o) - plus all the other office supplies you need

- Meet your payroll on time (which includes paying yourself - you *are* paying yourself I hope)

- Keep a full tank of gas in all of your truck(s)

- Never be without the tools you need on a job, even specialized tools

- Put more jobs on the board!

That's right ... Construction invoice factoring can help you to put more jobs on your board! How?

Suppliers prize customers that pay their bills on time...

- Those prized customers are given special, discounted pricing

- Those discounted material prices allow you to lower your bid prices

- Those lower bid prices mean you can afford to have more projects on the board

Not even

mentioned above is the additional discount that suppliers often give

when an invoice is paid within 10 days of issue!

Top-quality craftsmen are attracted to top-quality companies and employers

- As you put more jobs on the board your cash flow, and financial position, will get better

- As your financial position betters you'll be able to offer higher wages

- Higher wages will have the top-quality craftsmen asking to work for your company

Construction invoice factoring makes the above possible. You can afford to employ the top guys/gals in the trade which will eventually translate to even *more* jobs on the board.

Keep in mind though that in order to keep these top artisans as your employees you'll have to keep them busy.

If

you don't have work for them they'll have to go elsewhere. Then you're

stuck when you get a job and need employees but they're all already on

the payroll of another company, committed to a project.

Keep factoring invoices here and there in order to keep the cash flow going in order to keep your workers busy on new jobs at good wages. Eventually you won't have a problem getting jobs to keep them busy full-time because after all who doesn't want to hire the company that has the top team of craftsmen, and at such a great price?

Be #1 in your industry

With top-quality workers in the field and suppliers at your beck and call you'll quickly become the #1 company within your trade. With the reputation of being #1 comes more work.

Won't it be great when the point comes that you're turning down jobs instead of looking for projects to bid on!

Purchase the best tools for the job when you need them

You know that tool you've been drooling over, the one that'll put your business ahead of the competition? Sell an invoice to your factor and you can saunter on into the store and buy that puppy on the spot. Then use that drool-worthy tool to get your work done faster so that you have time to put yet more jobs on the board.

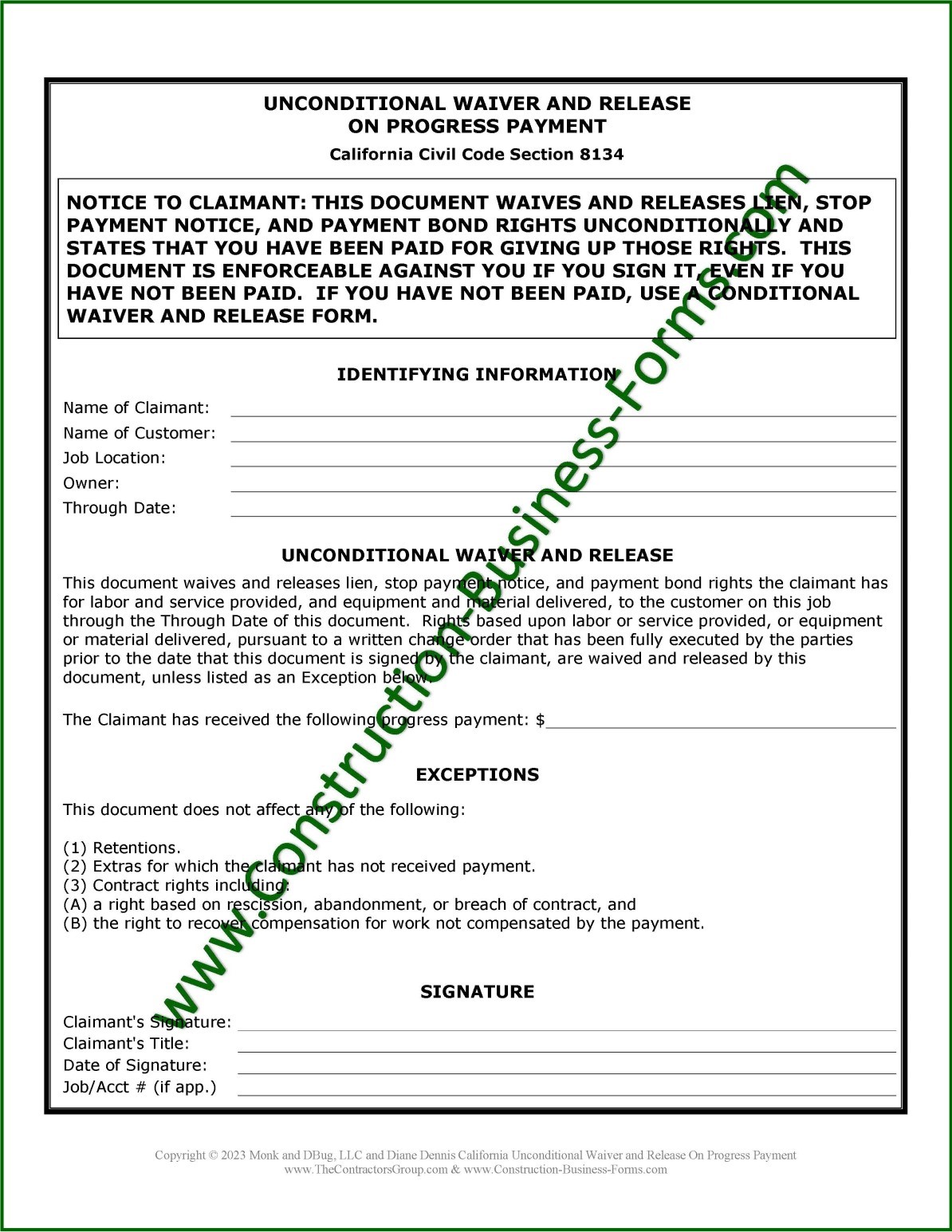

Enjoy unlimited nights of good sleep

Something I didn't mention above is that sometimes employers find themselves without enough money to meet payroll on any given week. No longer a nightmare-inducing problem... factor an invoice to get the cash flow needed for your payroll (remember that you can cash in 1 to 2 days) - and enjoy a good night's rest!

There's good things and there's bad things that come with being in business for yourself. By far one of the worst things is the immediate insomnia that sets in when you 'hang your shingle' and leave your boss's employ. Typically it's anxiety about how you're going to pay the bills. Construction invoice factoring is the answer. If you're stressing over how you're going to pay the bills factor an invoice, pay the bills, and move on.

Construction invoice factoring is definitely a viable way to manage your cash flow

It's no secret that almost every company goes through those excruciatingly tight times and the bills are piling up.

During those tight times, and/or should you decide to grow your business when those wonderful but sometimes fleeting opportunities present themselves , consider looking into factoring your construction invoices.

Check out our eBook titled "Get Paid!".

New! Comments

Please leave me your comments below. Facebook doesn't notify me of comments but I'm tickled when I come across them and I always respond when I see them.